In relation to shielding your economic potential, insurance coverage plans are an important aspect to take into consideration. Consider insurance policies as a safety Internet. It catches you when everyday living throws unpredicted difficulties your way. No matter if it’s health problems, car mishaps, or simply a dwelling fireplace, the right insurance prepare generally is a lifesaver. But with lots of possibilities available, how do you know which strategy is most effective for you personally? Allow’s dive in and examine what insurance plan plans are, why they’re essential, and how to pick the ideal a person for your needs.

Insurance policy designs are primarily agreements amongst you and an insurance company. In Trade for shelling out frequent premiums, the insurance company agrees to offer monetary help inside the event of particular risks or losses. Imagine it like a subscription to relief. By organising an insurance policies strategy, you happen to be basically transferring several of the money risks you deal with on the insurance plan company. This implies a lot less anxiety when the sudden transpires.

Some Known Incorrect Statements About Insurance Plans For Families

Different types of coverage ideas are built to go over many challenges. Wellness insurance policy strategies, such as, aid deal with health-related expenses, ensuring that when you are unwell or hurt, you received’t should pay back the total price for cure outside of pocket. Vehicle insurance coverage, Conversely, shields you through the fiscal fallout of a collision, like repairs, lawful charges, and damages. Likewise, lifetime insurance options ensure your family members are monetarily safe if one thing happens for you.

Different types of coverage ideas are built to go over many challenges. Wellness insurance policy strategies, such as, aid deal with health-related expenses, ensuring that when you are unwell or hurt, you received’t should pay back the total price for cure outside of pocket. Vehicle insurance coverage, Conversely, shields you through the fiscal fallout of a collision, like repairs, lawful charges, and damages. Likewise, lifetime insurance options ensure your family members are monetarily safe if one thing happens for you.Picking out the right insurance coverage approach might be frustrating because there are numerous choices. It is like walking into a candy shop having an unlimited range of sweets. But just as you'll pick the candy you prefer most effective, you have to pick the coverage prepare that matches your needs. The real key is To guage your challenges and figure out what type of protection will provide you with essentially the most protection with no breaking the financial institution.

Wellbeing insurance policy designs are Just about the most essential sorts of protection. Health-related charges can promptly include up, and a superb well being system makes sure you aren’t drowning in credit card debt after you need to have clinical care. Health insurance also can give usage of normal Examine-ups, preventive treatment, and prescription prescription drugs. With all the soaring cost of Health care, an extensive health and fitness insurance program isn’t merely a luxurious – it’s a necessity.

Automobile insurance coverage is yet another crucial method of safety. It doesn’t just safeguard your car or truck from injury but additionally covers liability in case of a collision. In some instances, it even covers health care fees for accidents you maintain in the course of an auto crash. You can find distinct amounts of protection readily available, together with liability, collision, and complete insurance plan. Each type presents distinctive amounts of protection, so it's important to pick one depending on your needs and price range.

Homeowners’ insurance policy ideas safeguard a person of one's most vital investments: your own home. Such a coverage ordinarily includes security against natural disasters, hearth, theft, and vandalism. It may additionally supply liability protection if another person will get hurt with your residence. Provided the amount of we spend money on our households, homeowners' insurance policies is essential-should protected your financial potential and ensure you're not remaining higher and dry if disaster strikes.

Renters insurance is yet another well-known choice, especially for individuals that don’t have their residences. While landlords are required to have insurance policies on the residence, renters in many cases are still left to fend for by themselves if their possessions are weakened or stolen. Renters insurance policy is economical and offers protection for personal assets, liability, and extra dwelling bills if your property will become uninhabitable.

With regards to everyday living insurance plan, many people don’t think about it until eventually afterwards in everyday life. But the earlier you spend money on a daily life insurance policy approach, the better. Everyday living insurance makes sure that Your loved ones is economically safeguarded if one thing happens for you. It could go over funeral expenses, pay back credit card debt, Learn the truth and supply for your personal family members as part of your absence. You'll find differing types of lifestyle insurance coverage programs, for instance time period everyday living and total everyday living, Each individual giving varying levels of security and Gains.

Disability coverage is designed to present money substitution if you’re struggling to perform on account of sickness or injuries. For people who rely on their paycheck to deal with residing expenses, disability insurance policy could be a lifesaver. It truly is Discover everything A vital Element of a effectively-rounded economical system, particularly if you're employed within a bodily demanding occupation or are self-employed. With the best incapacity prepare, you gained’t have to bother with how to pay the charges while you Recuperate.

Indicators on Insurance Experts You Need To Know

For people who take pleasure in travel, vacation coverage is a thing to take into consideration. Regardless of whether it is a canceled flight, missing baggage, or health-related emergencies overseas, travel insurance plan delivers relief. According to the program, it can cover a variety of eventualities, ensuring you are not remaining stranded or economically burdened whilst absent from your home. It’s one of those belongings you hope you under no circumstances require, but are grateful for Should the unpredicted takes place during your excursion.Extended-phrase care insurance policy ideas are sometimes disregarded, but they supply coverage for nursing property treatment, assisted dwelling, and in-household treatment services. As we age, our capability to execute everyday actions may well diminish, and long-expression care insurance policy helps include the costs of such solutions. It’s an essential style of coverage for seniors or Individuals organizing for retirement, as Health care expenditures in previous age might be prohibitively expensive without the need of this coverage.

Pet insurance coverage ideas can be a climbing craze amongst pet owners. Very similar to wellbeing insurance policy for people, pet insurance policy aids go over healthcare fees on your furry mates. Vet visits, surgical procedures, treatments, and drugs can speedily include up, and an excellent pet insurance policies system can make certain your dog will get the most effective treatment with out putting a strain on your funds. It’s an financial commitment while in the wellbeing and happiness of the pets.

Considered one of the main advantages of insurance policy programs is that they provide you with a monetary safety Web, serving to you stay afloat for the duration of hard instances. But Do you realize that numerous plans also give further perks? By way of example, some well being coverage strategies offer you wellness courses, reductions on gym memberships, and preventative care providers. Vehicle coverage organizations may provide special discounts for Protected driving, though homeowners’ insurance coverage policies normally supply reductions for installing security programs.

Whenever you’re buying insurance policy, it’s essential to compare options from different providers. Each and every insurance company provides somewhat unique conditions, coverage possibilities, and pricing. Consider it like searching for a pair of jeans; you wouldn’t accept the main pair you try on without ensuring that they suit excellent. By comparing distinctive insurance policies ideas, you ensure that you’re obtaining the ideal deal for your requirements.

Online Insurance Solutions for Dummies

Don’t overlook to browse the good print! Insurance coverage guidelines is usually complicated, and it’s necessary to be aware of the conditions in advance of committing. Some options might need exclusions or restrictions which could leave you exposed in selected cases. One example is, some wellness insurance plan plans don’t protect particular treatment options or pre-current problems, and a few motor vehicle insurance coverage procedures may well exclude certain forms of accidents. Constantly read through the phrases and question queries if one thing doesn’t seem sensible.

A different crucial thing to consider is your price range. When it’s tempting to select the cheapest insurance program, it’s important to equilibrium Price with protection. The very last thing you wish is to economize upfront, only to learn that your plan doesn’t offer satisfactory security if you require Explore this page it most. Seek out a prepare that fits comfortably in just your spending budget even though featuring sufficient protection for your requirements.

Insurance plan designs are all about controlling possibility. Lifetime is full of uncertainties, but with the appropriate insurance policies, it is possible to reduce the economical effects of These uncertainties. Whether or not it’s a overall health emergency, a vehicle accident, or a house maintenance, insurance plan is there to assist you Get better without having draining your bank account. By choosing the proper coverage system, you're not only defending your upcoming but also purchasing your reassurance.

In conclusion, insurance policy strategies are an essential part of any economic technique. They provide safety, security, and satisfaction, guaranteeing that you choose to’re protected when existence throws you a curveball. From wellbeing insurance plan to pet insurance policies, there’s a prepare in existence For each need. The crucial element is to know your dangers, Examine distinctive alternatives, and pick the system that best fits your Life-style. So, why wait? Take the time nowadays to secure your fiscal foreseeable future with the correct insurance system!

Judd Nelson Then & Now!

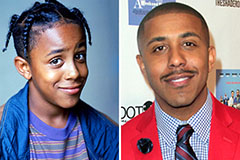

Judd Nelson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!